31+ how to drop mortgage insurance

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Homebuyers who put down less than 20 of the sale price will have to pay PMI until the total equity of the home reaches 20.

How To Cancel Private Mortgage Insurance Or Pmi

Web Eventually your mortgage insurance will fall away automatically but its a good idea to keep track.

. Call us at 1-800-357-6675 if you have questions about removing your MIP and one of our customer. Web If youre looking to ditch your monthly PMI payments here are a few options. Web SVBs collapse came suddenly following a frenetic 48 hours during which customers yanked deposits from the lender in a classic run on the bank.

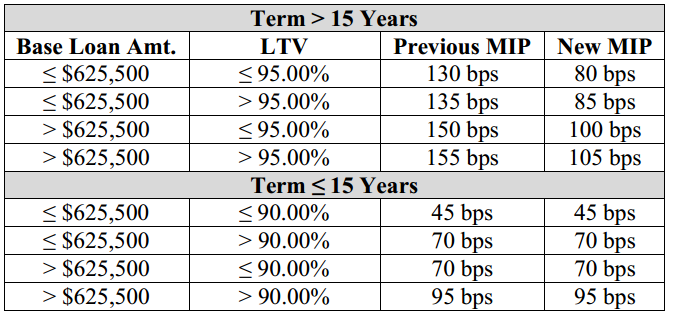

An upfront premium UFMIP and an annual premium. Web How Refinancing FHA Loans Can Remove Mortgage Insurance One option to remove mortgage insurance is to refinance an FHA loan into a new loan. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web The Consumer Financial Protection Bureau CFPB says federal law provides rights to remove PMI payments for many mortgages. With a 15-year fixed-rate FHA mortgage you can drop insurance as soon as your mortgage loan. Web Like private lenders the FHA requires you take out mortgage insurance.

Web There are two components for MIP. 1 requesting PMI cancellation or 2. Pay down your mortgage.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. As of this writing the upfront premium rate is 175 of the loan. Web 3 Tips To Drop Mortgage Insurance Keep paying off your home loan.

Get an idea of your estimated payments or loan possibilities. Web To stop paying mortgage insurance premiums youd need to refinance out of your FHA loan. The good news is that there are no restrictions on refinancing out of FHA.

Dropping MIP from FHA Loans If you make a 10. You have the right to request that your. One way to get rid of mortgage insurance is just to keep paying off your loan until you.

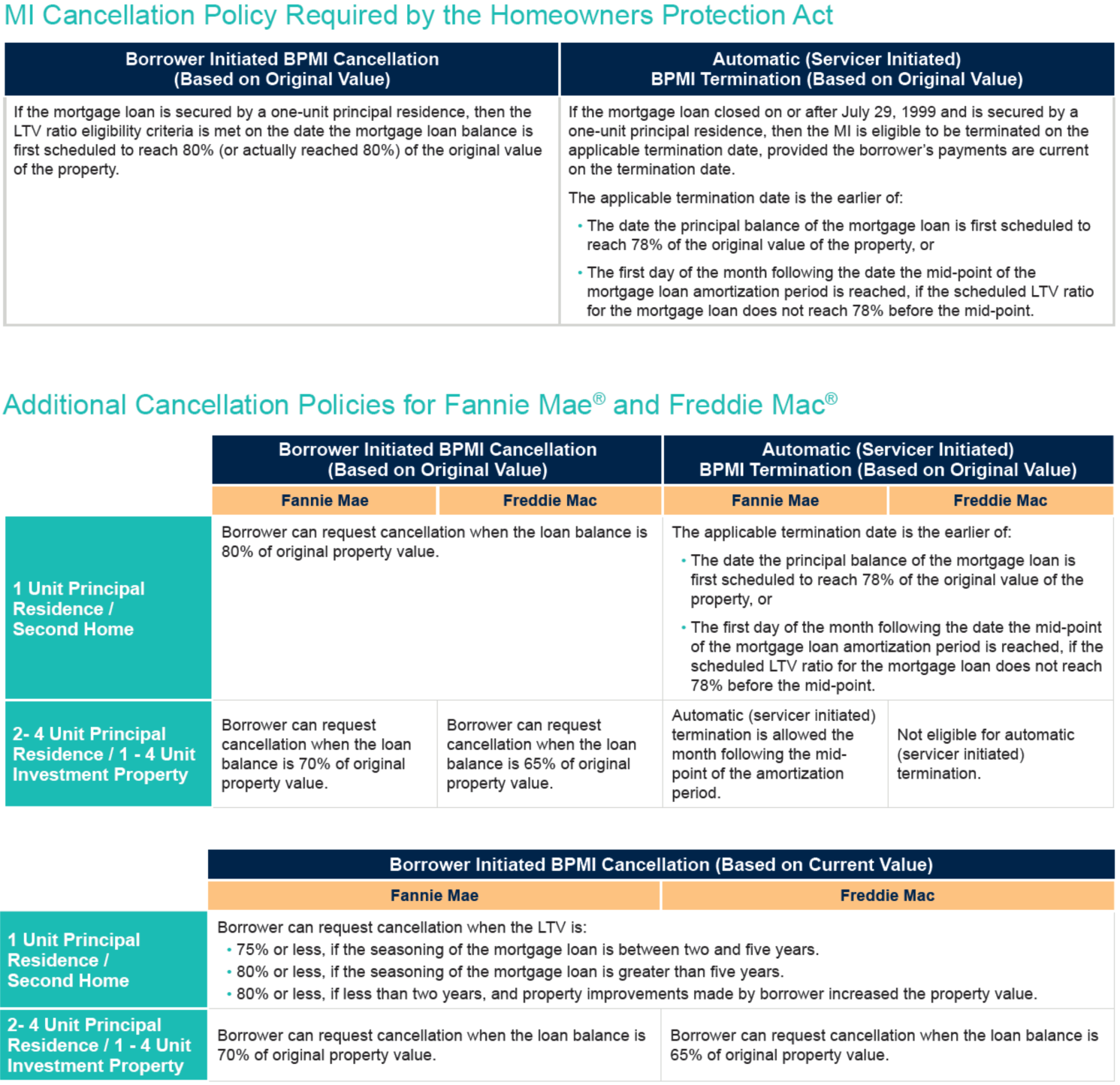

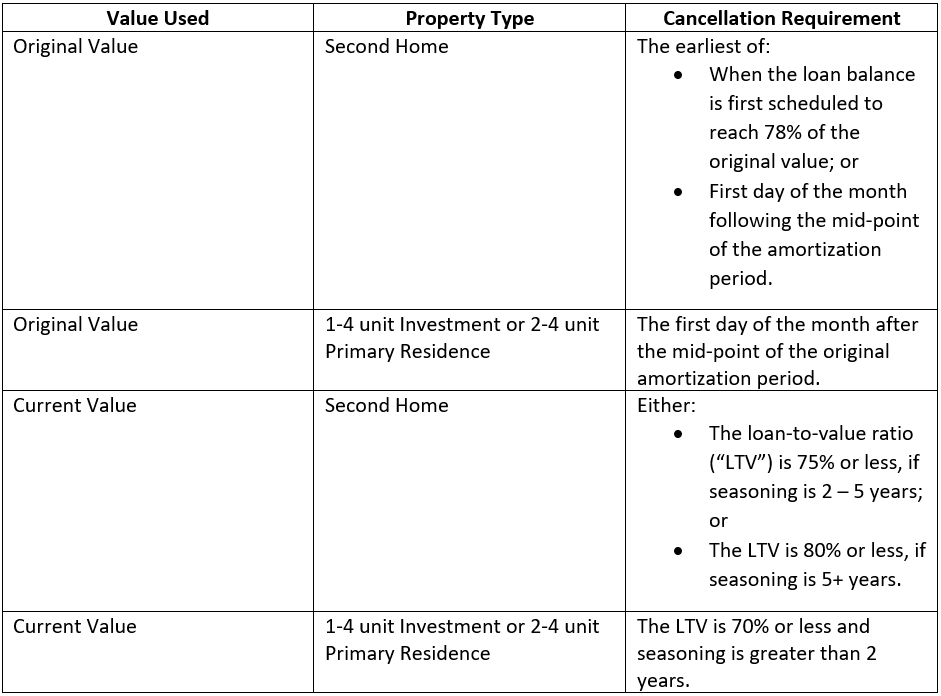

Get to where you only owe 80 of your homes value. Web The federal Homeowners Protection Act HPA provides rights to remove Private Mortgage Insurance PMI under certain circumstances. Web The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to the Urban.

Request a written copy of your PMI cancellation schedule and. Web Applied after June 2013 and your loan amount was greater than 90 LTV. Try our mortgage calculator.

Web Speak with a loan officer at the bank servicing your mortgage about your options to drop mortgage insurance. Web Lender-Paid Mortgage Insurance And Mortgage Insurance Premiums You can only remove your payments through a refinance if you have LPMI or you have MIP. The law generally provides two ways to remove PMI from your home loan.

What Is Private Mortgage Insurance Pmi And How To Remove It

How To Get Rid Of Pmi The Motley Fool

How To Get Rid Of Mortgage Pmi Payments Bankrate

How To Cancel Private Mortgage Insurance Pmi

Vernon Morning Star May 31 2015 By Black Press Media Group Issuu

Petron Annual Report 2019 Sec Form 17 A Pdf Motor Oil Business

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/DVENROHZ2ZBDNMEWM5JET5YCLA.jpg)

How To Get Rid Of Pmi The Dough Roller

Reminder Private Mortgage Insurance Is Temporary The New York Times

How To Get Rid Of Pmi Nerdwallet

The Interrelations Of Laws And Rules Affecting Mortgage Insurance Compliance

Village Post August 2022 By Post City Magazines Issuu

What Is Pmi Understanding Private Mortgage Insurance

How To Get Rid Of Pmi Nerdwallet

4 Ways To Ditch Pmi Lower Your House Payment Finder Com

Fha Slashes Mortgage Insurance Premium How Much Will You Save California Mortgage Broker

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures

Cis Pmi Questions And Answers